How to reduce risk and keep your business stable?

Because it is normal for there to be events that permeate the course of business in any company in the world, experienced thinkers and business owners have realized that there are many repercussions that come from not being aware, anticipating and managing risks. Hence the science of risk management, a science associated with business maintenance, arose in more than one way (which is a very simplified definition).

Show key points

- Risk management is a crucial discipline that helps businesses anticipate, assess, and mitigate potential threats to ensure long-term stability and success.

- Through risk management, companies can protect vital assets such as property, financial resources, and data from unexpected disruptions.

- Effective risk planning not only safeguards operations but also helps maintain business continuity during unforeseen events or crises.

- ADVERTISEMENT

- Identifying and evaluating risks allows companies to seize new opportunities and make smarter, more strategic decisions.

- Various strategies like risk avoidance, mitigation, transfer, and acceptance are essential components in addressing and reducing business risk.

- Continuously monitoring and updating risk management plans is necessary to adapt to changing business conditions and maintain effectiveness.

- Involving stakeholders, using technology, obtaining insurance, and seeking expert advice are practical steps that strengthen your risk management efforts.

Risk management is defined as the process of identifying, assessing, and taking steps to reduce your company's impact. Risk management is essential to any successful business, helping you to:

Protect your assets: By identifying and minimizing risk, you can protect your company's assets, such as property, equipment, and financial data.

Recommend

Maintain business continuity: It can help you avoid interruptions or delays in your operations, ensuring that your business continues smoothly.

Seizing opportunities: It can help you identify new opportunities and make informed decisions on how to take advantage of them.

Improve financial performance: By reducing risk, you can improve your profits and reduce your costs.

Improve decision-making: The risk assessment process helps you make more informed decisions and manage your operations more efficiently.

Enhance compliance: Help you comply with applicable laws and regulations, avoiding fines and penalties.

Create competitive advantage: Effective risk management enables you to gain a competitive advantage by demonstrating your commitment to the stability and sustainability of your business.

How to reduce risk and keep your business stable?

There are several steps you can take to reduce risk and keep your business stable, including:

1. Identify risks: The first step is to identify the risks your company may face. This can include financial risks, such as market and credit risk, operational risks, such as natural disaster risks and power outages, and legal risks, such as litigation risks.

2. Risk assessment: Once the risks are identified, you should evaluate them to determine the likelihood and severity of their occurrence. This will help you identify the most important risks you need to address.

3. Addressing risks: There are a number of ways to reduce risk, including:

Avoidance: The best way to reduce risk is to avoid situations that create it in the first place. That is, avoid risks completely by avoiding the activities or situations that cause them.

Mitigation: Reduce the likelihood or severity of hazard. This can include buying insurance. Implement prevention measures, or develop/implement contingency plans.

Transfer/delegation: The process of giving responsibility for risk management to another party, such as an insurance company, or companies specialized in it.

Preparation: Accept risks and retain their potential costs. And be prepared to bear the consequences if they occur.

4. Develop a risk mitigation plan: For each specific risk, you have to develop a plan to mitigate or eliminate it. Risk mitigation plans may include risk transfer, risk avoidance, risk reduction, and risk retention.

5. Plan Implementation: After developing a risk mitigation plan, you should implement and track it regularly. It is important to conduct in-house trainings with employees for this. One of the most important elements to keep in mind is the surrounding environment in the company.

6. Review and update your risk plan: As your business conditions change, you should review and update your risk plan regularly.

7. Risk monitoring: It is important to monitor risks regularly to ensure that they remain effective. You may also need to update your risk management plans as your business conditions change.

Additional practical risk management tips

Involve all stakeholders: It is important to involve all stakeholders in the risk management process, including employees, customers and suppliers. This will help you get a comprehensive perspective of the risks your company is facing.

Gain risk management training: There are many resources available to help you learn more about risk management. You can attend courses, read books and articles, or join professional organizations.

Review risk management plans regularly: Risk management plans should be reviewed regularly to ensure they remain effective. You may also need to update your plans as your business circumstances change.

Invest in risk management technology: Software and risk management tools can help you automate risk management tasks and improve the effectiveness of your risk management process.

Get proper insurance: Insurance can help you protect your business from financial losses caused by insured risks.

Consult a risk management expert: If you need risk management assistance, you can consult an expert in the field.

By following these steps, you can reduce the risks your company faces and keep your business stable.

![]()

How to deal with difficult people and people with a capricious mood?

How to deal with difficult people and people with a capricious mood? more- ADVERTISEMENT

![]()

The Dream of Getting Rich Quick: Stories of Turning Good Fortunes into Millionaires Overnight

Overnight Millionaires: People Who Got Rich Quick more- ADVERTISEMENT

![]()

The best professional advice (in life) one can get

Choosing the right career can be tough, but combining self-assessment, research, and goal-setting with expert guidance makes the path clearer. Tools like MBTI and career mentors help align your job with your values, making your professional journey both successful and fulfilling. more- ADVERTISEMENT

![]()

Moving forward still represents progress: trusting the process and taking my own best advice

Moving forward still represents progress: trusting the process and taking my own best advice more- ADVERTISEMENT

![]()

How is Dubai developing a farm in the heart of the desert?

Dubai is turning desert into farmland using hydroponics and vertical farming, creating a green oasis in harsh conditions. This bold project boosts food security, reduces water use, and embraces clean energy—showing the world how innovation can grow crops where none thought possible. more- ADVERTISEMENT

![]()

Elon Musk - mad genius or unlimited diligence?

Elon Musk, dubbed the "Real Iron Man," is a bold, creative dreamer known for his ambition to colonize Mars, controversial tweets, and strict leadership style. Loved and hated, he's a complex figure who never shies away from challenges or attention, always pushing boundaries with fearless determination. more- ADVERTISEMENT

![]()

Can you get into Svalbard's seed vault?

Tucked inside a remote Arctic mountain, the Svalbard Global Seed Vault stores over 930,000 crop varieties as a backup for global food security. It's a quiet champion, preserving biodiversity and standing ready when disaster or conflict strikes, like it did for Syria’s lost gene bank. more- ADVERTISEMENT

![]()

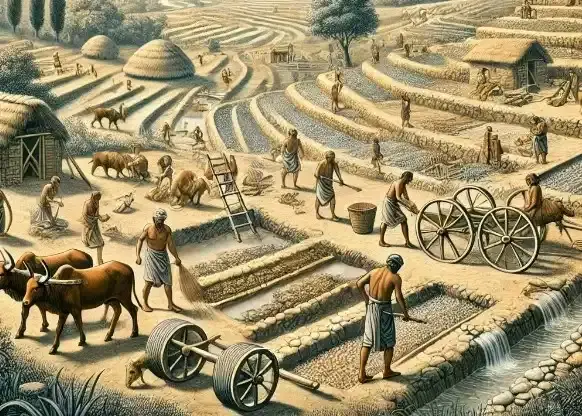

Neolithic revolution

The Neolithic Revolution more- ADVERTISEMENT

![]()

The Five Great Scandals in Climatology

Climate science has faced serious issues, from fake datasets in top journals to the use of extreme, unrealistic emission scenarios. Political pressure often blocks correction, making it hard to fix flawed research. These scandals show how climate science can struggle when science and politics mix too closely. more- ADVERTISEMENT

![]()

Sacred places in the Andes: 7 secrets of Machu Picchu

Machu Picchu isn't truly the lost city of the Incas, and it's not as forgotten as once believed—locals were living there when rediscovered. Many marvels are hidden underground, and if you're up for a sweaty climb, you can skip the pricey bus and enjoy epic views for free. more- ADVERTISEMENT