5 habits to save on your monthly allowance

Many of our habits cause our monthly allowance to bleed and we are upset by the feeling that money is never enough and some of us even go into debt even though our income is acceptable. The debt does not necessarily have to be from others but the debt can be by credit card payments and inability to repay in the same month.

We need to adopt new habits that may contribute to controlling the waste of money and increasing our awareness of money exchange channels and being able to control and modify them in a healthy way. Follow this article to create new daily and monthly habits that help you solve the problem.

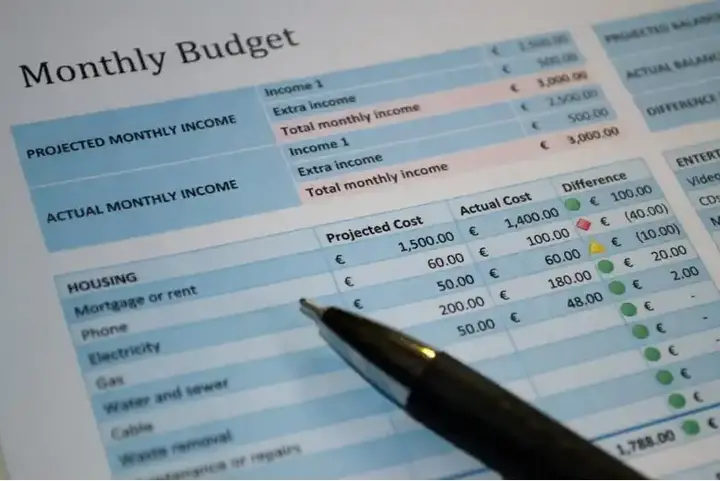

1. Set a monthly budget

It is impossible for us to solve a problem without knowing what the problem is in the first place, setting a written monthly budget will put your hand on the problem and then you will be able to solve it in acceptable ways. There is more than one way for the monthly budget, such as the 50/30/20 theory, which is to put 50% of your income for basic needs (basic food - regular medicine - rent / monthly bills / school fees...). The 30% is for luxuries (new clothes / dining in a restaurant / cinema ...). Finally, the 20% savings clause (for the future or for urgent situations such as sudden illness or unforeseen events). You can change the percentages based on basic needs in the case of limited income, but try your best to save at least 10% and the priority is given to needs over luxuries. Remember that it is necessary to record all the items of disbursement divided into these categories only then you can get your hands on the item with which your monthly budget collapses. Think of it as a way to awaken awareness about the disbursement items so that you can start adjusting them. You can register manually, using mobile apps, or using Excel sheet.

Recommend

2. Pay attention to the difference between what you want and what you need

You are often confused about what you want and what you really need. You should pay attention to the difference every time you spend money. While passing in front of a clothing store, for example, you noticed a very striking product, your favorite color or model, so you thought about trying it... Stop, do you need it or do you just like it! When we have a monthly plan drawn up and awareness of our needs we can better control the urge to buy what we do not need.

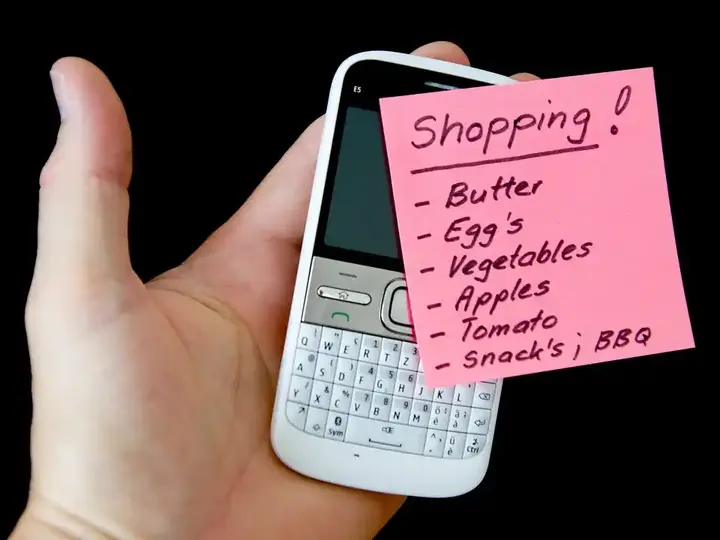

3. Select your weekly shopping list

Have you noticed that every visit to the supermarket you come back with things that are completely different from what you originally went to buy. Don't leave home without a clear shopping list based on your weekly meals. This way you can control the urge to buy unnecessary things and protect food from spoilage.

If you like something or find it offered at a better price, immediately replace it with something else on your shopping list. If you notice that the price of a product you used to buy is too high, look for alternatives to the same product at a better price. If you pick up your children while shopping, agree with them on what they can spend before leaving the house and don't back down on your decision.

4. Handle offers carefully

Most of us notice that we overpay during offers which is one of the purchasing tricks followed by companies. We often buy products during promotions and in fact we never need to buy them, thinking that we are saving money in this way. Remember the second habit of differentiating between what we want and what we need. Offers really save when we buy only what we need. When you buy products you don't need during the shows, you lose part of your monthly income that should have paid for a real need. Be careful not to leave the house with a credit card on the day of the promotions, direct purchase with cash will help you control the amount spent.

5- Choose the best saving method for you

As your income increases, you will notice that you have expanded your monthly expenses and turned many luxuries into basic needs. However, your savings usually do not increase and are sometimes ignored. There are plenty of ways you can help you stick to your monthly savings item.

For example, if your salary is transferred through the bank, you can follow the automatic saving method, which is available through your bank account settings, where a percentage of it is automatically deducted for savings. You can also save by purchasing gold coins in small denominations. You can meet the bank's customer service staff and inquire about all safe savings and investment alternatives.

You can gradually save if the habit of saving is completely new to you, with the help of your family members, start with daily or weekly savings and then increase it periodically until it reaches at least 10% of your income.

![]()

Babylon... The empire engraved in the memory of history

Babylon, once the world's largest city and symbol of power, was famed for its Hanging Gardens and Hammurabi's laws. Despite its fall, religious texts and historians kept its memory alive, portraying it with awe or condemnation. Rediscovered centuries later, it remains a symbol of legacy and greatness. more- ADVERTISEMENT

![]()

The most important job market skills - how to become a graphic designer?

Graphic design is a creative field where your imagination meets visual communication. It’s not just about art—it’s about problem solving, storytelling, and expressing ideas. With the right skills, passion, and patience, you can turn your love for design into a rewarding profession that AI can’t fully replace. more- ADVERTISEMENT

![]()

Bermuda Triangle Puzzle

The Bermuda Triangle remains a thrilling mystery filled with tales of vanishing ships, eerie time loss, and ghostly weather. Despite scientific theories and advanced research, the true cause of these disappearances continues to puzzle and intrigue the world. more- ADVERTISEMENT

![]()

Habits that distinguish men from boys

Habits that distinguish men from boys more- ADVERTISEMENT

![]()

Saving our seas: Can we remove plastic pollution?

Plastic pollution is everywhere—from oceans to our drinking water. Ocean cleanup efforts like The Ocean Cleanup aim high but also come with side effects, including harming marine life and adding to carbon emissions. The real solution? Stop single-use plastic at the source before it ever reaches the sea. more- ADVERTISEMENT

![]()

The importance of social communication for public health

The importance of social communication for public health more- ADVERTISEMENT

![]()

Medical foods in Vietnam: amazing, embarrassing, and puzzling

In Vietnam, food is more than nourishment—it's tied to ancient beliefs. One odd belief warns against pairing chicken with lemon mint leaves, thought to cause leprosy-like symptoms. Though not dangerous, it may cause discomfort. Traditional dietary therapy blends food with yin-yang balance, offering deeper awareness of health and lifestyle. more- ADVERTISEMENT

![]()

The splendor of nature and the challenge of conditions in the oasis of Taghit in western Algeria

Taghit is a hidden gem in western Algeria, where golden dunes meet ancient history. Adventure seekers can sandboard down towering dunes, explore mysterious caves, or discover 20,000-year-old rock carvings. The ancient walled city of Kassar, once forgotten, is now being restored to its former glory. more- ADVERTISEMENT

![]()

Global Solar Radiation: Regional Disparities and the Potential of the Middle East

Bathed in sunlight and embracing vast deserts, the Middle East shines as a global leader in solar energy. With over 3,000 annual sunshine hours, the region fuels innovation and growth, setting the stage for a bright, clean-energy future powered by the sun. more- ADVERTISEMENT

![]()

Nine mythical places that may have already existed: tracing the line between myth and reality

From Atlantis beneath the waves to El Dorado's golden allure and Shambhala's spiritual sanctuary, these legendary places continue to spark wonder. Though their existence remains unproven, ongoing discoveries and ancient clues keep the hope alive, blending myth with mystery in humanity’s quest for hidden truths. more- ADVERTISEMENT