First Steps to Investing: Practical Tips to Build Your Wealth

The pace of economic change is accelerating, and investment is emerging as one of the most important pillars for building sustainable wealth and achieving financial security. But delving into this area requires more than just capital; it requires a deep understanding of the foundations and strategies that lead to success. This article is aimed at beginners seeking to establish their first steps in the world of investing, providing them with practical tips and basic principles that will help them build their wealth with confidence and wisdom.

Show key points

- Understanding the basic principles of investing and the different types of assets is essential for beginners to build a solid financial foundation.

- Investors must evaluate the trade-off between risk and return to make informed decisions that align with their financial tolerance.

- Developing a clear investment plan with defined short- and long-term goals helps guide strategy and asset selection.

- ADVERTISEMENT

- Diversifying across various asset classes such as stocks, bonds, real estate, and commodities reduces risk and enhances portfolio stability.

- Considering undervalued sectors or strong companies facing temporary setbacks can yield valuable investment opportunities.

- Success in investing requires patience, a focus on long-term goals, and the discipline to avoid reacting emotionally to market fluctuations.

- Avoiding common pitfalls like investing all capital in one asset, using borrowed funds, and relying on unreliable advice is crucial for maintaining financial security.

We begin our journey by learning about the basic concepts and distinguishing between different investment options, through how to develop a balanced investment plan that suits our objectives and our ability to bear risks. We will also explore tips that enable investors to achieve success and avoid common mistakes that may hinder their journey. Let's begin this exciting journey toward building a brighter financial future.

Recommend

Familiarity with the basics of investment

Understand investment mechanisms and types

In order to start your investment journey, it is essential to understand the mechanisms that govern financial markets and the different types of investment assets. From stocks and bonds to mutual funds and real estate, each type carries its own unique characteristics and different levels of liquidity and risk. New investors should familiarize themselves with these categories and understand how each can fit into their investment goals.

Assess potential risks and returns

Investing always means dealing with risks and returns. Understanding the relationship between them is vital to making informed investment decisions. Investors should assess how willing they are to bear losses against potential opportunities for profit. Analysis of volatility in the markets and the price history of assets is an integral part of this assessment.

Short and long-term investments

Investments vary according to the time horizon. Short-term investments, such as financial market accounts and certificates of deposit, offer higher liquidity and lower risk, but may offer lower returns. In contrast, long-term investments such as stocks and real estate hold the potential for higher returns, but they require greater patience and tolerance for volatility. Investors should choose the strategy that aligns with their goals and time horizon.

Develop an investment plan

Setting investment objectives

Setting investment goals is the first and essential step in building a successful investment plan. These goals must be clear, measurable, and time-bound. Whether the goals are related to saving a certain amount for retirement, buying a home, or educating children, they must be precisely defined to guide investment decisions and determine the appropriate assets to achieve them.

Building a diversified investment portfolio

Diversification is an essential strategy for risk management in investing. Building an investment portfolio that includes a variety of assets can help reduce the negative impact of market volatility on investments. The portfolio should include a mix of stocks, bonds, real estate, and possibly cryptocurrencies or commodities, in proportions commensurate with the investor's goals and time horizon.

Investing according to risk tolerance

Each investor has a different level of risk tolerance. The investment strategy must fit this ability to ensure psychological comfort and avoid hasty decisions in times of crisis. Investors with less risk can invest in more stable assets such as government bonds, while investors with higher risk tolerance can look for opportunities in emerging markets or startups.

Tips for successful investment

Investing in generally undesirable areas

Sometimes, the most attractive investment opportunities are in areas that others avoid. These sectors or markets may be undesirable due to their volatility or associated risks, but they may provide opportunities to buy at low prices. Investors should thoroughly research and assess the true value of assets in these areas before investing.

Looking for good companies going through bad times

Strong companies facing temporary problems can present excellent investment opportunities. Investors must distinguish between transient difficulties and fundamental problems in the company. Investing in companies with strong fundamentals and good management during difficult times can lead to great returns when conditions improve.

Patience and thinking about long-term investment

Successful investment requires patience and long-term vision. Financial markets are inherently volatile, and thinking about investing in the short term can lead to hasty decisions and unnecessary losses. Investors should focus on long-term goals and trust their investment strategies, while being prepared to withstand short-term market volatility.

Avoid common mistakes

Not putting all the money into one investment

Putting all the money into one investment is like gambling; it maximizes the risk. Diversification is the key to preserving wealth and protecting it from unexpected fluctuations. Investors should spread their investments across different categories and sectors to minimize risk and increase long-term growth opportunities.

Beware of investing with borrowed money

Investing with borrowed money can lead to serious consequences, especially if the market moves against you. Debt increases stress and reduces your ability to make informed decisions. It is always best to invest with money that you can afford to lose without affecting your financial stability.

Consult experts and avoid misleading advice

In a world full of conflicting information, it's essential to distinguish between valuable and misleading advice. Consulting trusted experts and financial advisors can provide you with clear visibility and help you avoid common mistakes. Be sure to check the sources of information and do not make decisions based on unreliable advice.

![]()

The historic citadel of Aleppo ... One of the largest and oldest castles in the world

Aleppo Citadel, one of the world’s oldest castles, stands proudly in Syria’s ancient city. Once a temple and fortress, it saw civilizations from Greeks to Ottomans. Its restored Mamluk throne hall, with marble and basalt details, remains a key highlight, offering insight into the citadel’s rich and layered history. more- ADVERTISEMENT

![]()

Elon Musk - mad genius or unlimited diligence?

Elon Musk, dubbed the "Real Iron Man," is a bold, creative dreamer known for his ambition to colonize Mars, controversial tweets, and strict leadership style. Loved and hated, he's a complex figure who never shies away from challenges or attention, always pushing boundaries with fearless determination. more- ADVERTISEMENT

![]()

The Dream of Getting Rich Quick: Stories of Turning Good Fortunes into Millionaires Overnight

Overnight Millionaires: People Who Got Rich Quick more- ADVERTISEMENT

![]()

Islamic Hijri calendar – its history, uses and possible improvement

The Hijri calendar, rooted in the 622 CE migration of Prophet Muhammad, holds deep spiritual and cultural meaning for Muslims. It guides key religious practices like Ramadan and Eid. While traditional sightings vary, astronomical calculations offer hope for more accurate and unified observances across the global Muslim community. more- ADVERTISEMENT

![]()

Embracing stupidity: the hidden value of our mistakes

Embracing stupidity: the hidden value of our mistakes more- ADVERTISEMENT

![]()

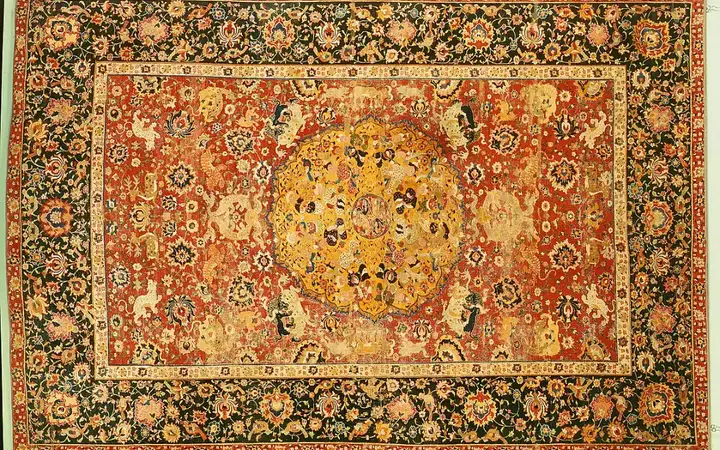

Iranian carpet industry ... History and economic significance

Persian carpets, woven with stunning detail and rich history, have long symbolized beauty and prestige. Once essential for warmth, they evolved into luxurious art pieces admired in royal courts. Today, they remain a global symbol of elegance and superior craftsmanship, cherished for their unique patterns and cultural legacy. more- ADVERTISEMENT

![]()

Blood test uses 'protein clock' to predict risk of Alzheimer's disease and other diseases

Blood test uses 'protein clock' to predict risk of Alzheimer's disease in others more- ADVERTISEMENT

![]()

Why do people buy? Simplifying the theory of purchase

Understanding why people buy is key in commerce—whether it's to meet basic needs, fulfill desires, or express identity. Buying behavior is shaped by psychological, social, economic, and marketing factors, and recognizing these helps create better marketing strategies that truly connect with consumers. more- ADVERTISEMENT

![]()

Understanding your leadership style: strengths and weaknesses

Understanding Your Leadership Style: Strengths and Weaknesses more- ADVERTISEMENT

![]()

The most expensive mistakes in history

The most expensive mistakes in history more- ADVERTISEMENT